Companies select Thoma Bravo due to our firm’s deep sector knowledge, demonstrated track record, partnership-oriented approach, and proven strategic and operational expertise. We bring our skills and experience to each of our investments and use them to help our portfolio companies excel in product innovation, operational excellence and sustainable growth. Our private equity investment vehicles employ the same investment philosophy – to partner with and support management teams to help deliver solid operating results and drive innovation.

Our business is anchored by The Thoma Bravo Flagship funds, which represent a series of private equity funds that focus on investing in large software and technology companies.

The Thoma Bravo Discover funds focus on investing in middle-market software and technology companies.

The Thoma Bravo Explore fund focuses on investing in lower middle-market software and technology companies.

The Thoma Bravo Growth fund focuses on making minority investments in software and technology companies.

The Thoma Bravo Credit funds focus on making debt investments in software and technology companies.

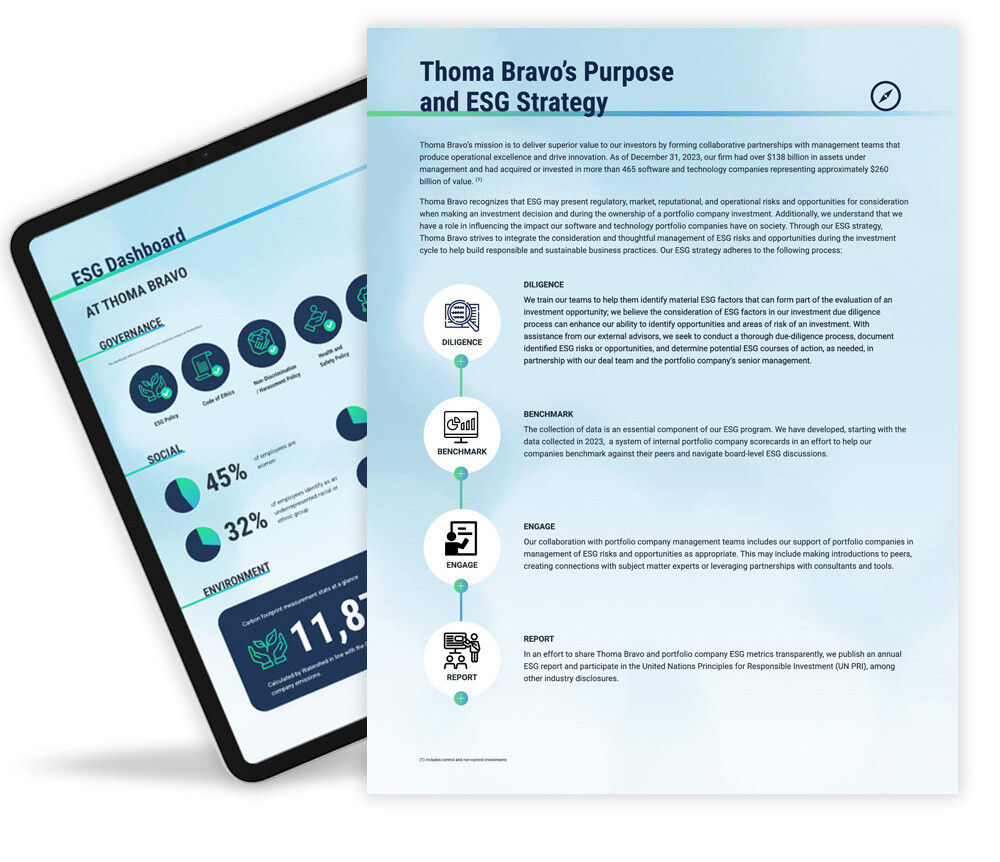

At Thoma Bravo, our mission is to deliver superior value to our investors by forming collaborative partnerships with management teams that produce operational excellence and drive innovation. We are a firm that celebrates entrepreneurship, creativity, and inclusion, and this ethos underpins our view of ESG.

Thoma Bravo approaches ESG through a materiality lens, and we recognize that material ESG issues may present regulatory, market, reputational, and operational risks and opportunities for consideration when making an investment decision and during the ownership of a portfolio company investment. As described in our ESG policy, we engage with our portfolio companies to help integrate ESG considerations that can drive value creation.

Additionally, we understand that we have a role in influencing the impact our software and technology portfolio companies have on society. Through our ESG strategy, Thoma Bravo strives to integrate the consideration and thoughtful management of material ESG risks and opportunities during the investment cycle to help build responsible and sustainable business practices.

The PRI is the world's leading proponent of responsible investment. It works to understand the investment implications of ESG factors and to support its international network of signatories in incorporating these factors into their investment and ownership decisions.

As a signatory of the ILPA Diversity in Action initiative, Thoma Bravo commits to supporting diversity and inclusion, both at our firm and across the industry more broadly. The Diversity in Action framework addresses talent management, investment management and industry engagement.

The information provided herein is for informational purposes only and is not an offer of Thoma Bravo’s investment advisory services and does not include any endorsement or testimonial for which Thoma Bravo has provided compensation. Any offer or solicitation regarding Thoma Bravo’s investment advisory services will be made only pursuant to a fund’s confidential private placement memorandum (as may be amended or supplemented, a “PPM”) and such fund’s agreement of limited partnership (“LPA”) and subscription documents, which will be furnished to qualified investors on a confidential basis at their request for their consideration in connection with such offering. Descriptions of Thoma Bravo’s ESG practices herein are subject to, and qualified in their entirety by, Thoma Bravo’s ESG policy.

110 N. Wacker Drive

32nd Floor

Chicago, IL 60606

+1 (312) 254-3300

1925 Cedar Springs Road

Suite 205

Dallas, TX 75201

+1 (214) 971-7777

Norfolk House

31 St. James’s Square

6th Floor

London, SW1Y 4JR

UK

830 Brickell Plaza

Suite 5100

Miami, FL 33131

+1 (786) 785-5800

375 Park Avenue

Suite 3603

New York, NY 10022

+1 (212) 292-7070

One Market Plaza

Spear Tower

Suite 2400

San Francisco, CA 94105

+1 (415) 263-3660

Thoma Bravo UK Advisers LLP is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 1016286).